Cryptocurrency in 2025 is not what it was five years ago. The wild price swings, the speculative frenzies, and the uncertainty surrounding regulations are beginning to settle into something more structured, more predictable—yet still full of opportunity.

Whether you’re a seasoned investor, a casual observer, or someone who still thinks “blockchain” is just a buzzword, 2025 is a crucial year for crypto. This article will help you understand what’s happening, why it matters, and how you can position yourself to benefit.

The Evolution of Crypto: Where We Are Today

To appreciate where cryptocurrency is headed, it’s important to acknowledge how far it has come.

- Bitcoin is no longer a niche experiment. It’s a mainstream financial asset, traded on Wall Street and held by some of the world’s biggest institutions.

- Ethereum has evolved beyond smart contracts. With the rise of Layer 2 solutions and Ethereum’s continued dominance in decentralized applications (dApps), it’s clear that blockchain technology is here to stay.

- Decentralized Finance (DeFi) is changing the way people access financial services. Loans, insurance, and even salaries are now being managed through blockchain-powered solutions—without traditional banks.

- Crypto payments are no longer futuristic. Major corporations are accepting crypto, stablecoins are being used for international transactions, and Central Bank Digital Currencies (CBDCs) are gaining traction.

However, despite these advancements, there are still challenges ahead: regulatory uncertainties, scalability issues, and public skepticism remain significant hurdles.

So, what’s next?

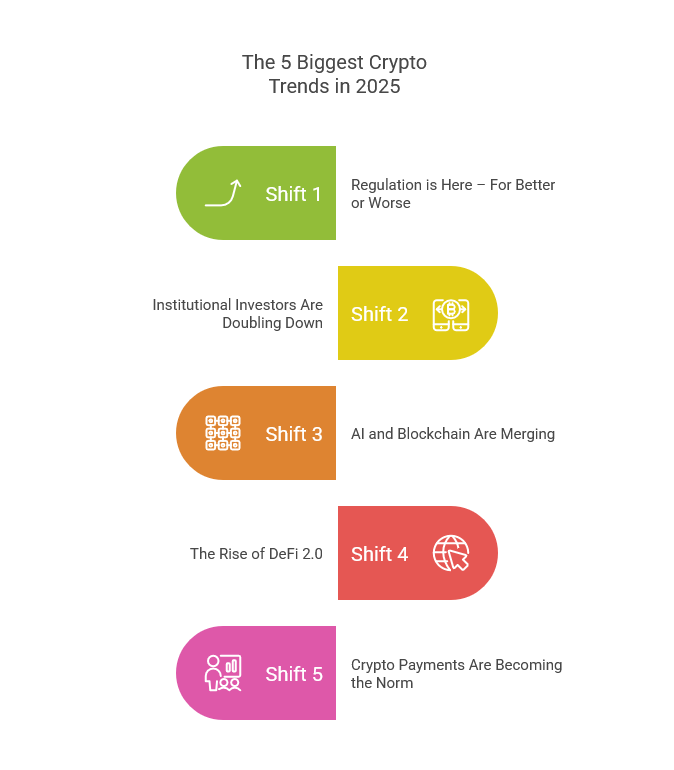

The 5 Biggest Crypto Trends in 2025

If you only focus on the past, you’ll miss what’s coming next. Here are the biggest shifts shaping the crypto industry in 2025:

1. Regulation is Here – For Better or Worse

For years, governments ignored crypto or treated it as an unregulated gray area. Not anymore.

- The U.S. and EU have implemented clearer tax laws and stablecoin regulations.

- Crypto exchanges now operate under strict Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

- Countries like India and China, once skeptical of crypto, are now testing Central Bank Digital Currencies (CBDCs).

What does this mean for you? More security, but also more scrutiny. Investors need to keep up with regulatory changes to avoid legal pitfalls, while businesses need to ensure compliance.

2. Institutional Investors Are Doubling Down

It wasn’t long ago that major financial institutions dismissed crypto as a passing trend. Today, the story is different.

- BlackRock and Fidelity now manage Bitcoin ETFs.

- Major banks offer crypto custody services.

- Hedge funds are actively trading digital assets.

This shift isn’t just about big money entering the market. It’s about stability. Institutional involvement means less extreme volatility, more liquidity, and a stronger foundation for long-term growth.

3. AI and Blockchain Are Merging

Artificial intelligence is reshaping industries, and crypto is no exception.

- AI-powered trading bots are now more efficient than human traders.

- Blockchain security is improving with AI-driven fraud detection systems.

- AI-generated smart contracts are reducing human error.

The combination of AI and crypto is still in its early stages, but it’s a space to watch—especially for those looking for investment opportunities in the tech-driven financial sector.

4. The Rise of DeFi 2.0

Decentralized Finance (DeFi) revolutionized how we think about lending, borrowing, and earning interest. But DeFi 1.0 had flaws: security breaches, unsustainable yields, and confusing interfaces.

Enter DeFi 2.0, a more sophisticated, user-friendly, and secure version of decentralized finance. Key improvements include:

- More sustainable yield farming strategies.

- Stronger security measures to prevent hacks.

- Integration with real-world assets like real estate and commodities.

If you missed the first wave of DeFi, now is the time to start paying attention.

5. Crypto Payments Are Becoming the Norm

It’s no longer just tech enthusiasts using crypto for transactions. Businesses, governments, and everyday people are adopting digital payments.

- Companies like Tesla, Microsoft, and Shopify now accept crypto payments.

- Countries like El Salvador and Argentina are expanding Bitcoin adoption.

- Stablecoins are being used for international remittances, reducing transfer fees and wait times.

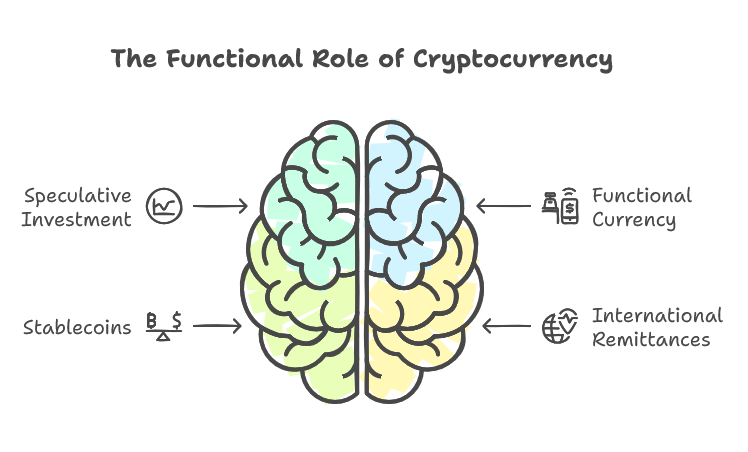

Crypto is no longer just a speculative investment—it’s a functional currency.

What These Changes Mean for You

Whether you’re an investor, an entrepreneur, or simply someone curious about cryptocurrency, these trends impact you. Here’s what you should consider:

If You’re an Investor:

- Keep up with regulatory updates—some investments may become more attractive, while others may face restrictions.

- Diversify your portfolio beyond Bitcoin and Ethereum to include emerging projects in AI, DeFi 2.0, and blockchain security.

- Use institutional adoption as a signal—if large companies are buying in, it’s worth investigating.

If You’re an Entrepreneur or Business Owner:

- Consider accepting crypto payments—it’s easier than ever and opens up new markets.

- Look into blockchain solutions for security, efficiency, and transparency in your business.

- Follow DeFi developments if you’re in finance—it’s changing how businesses access capital.

If You’re New to Crypto:

- Start small. Learn the basics before investing large sums of money.

- Use secure storage solutions like hardware wallets to protect your assets.

- Follow industry news from reliable sources to avoid scams and misinformation.

The Simple Takeaway

The biggest mistake you can make in 2025 is ignoring cryptocurrency. Whether you invest in it or not, digital assets are reshaping finance, and staying informed will help you make better financial decisions.

Crypto is evolving—not just as a speculative asset, but as a legitimate financial system.

How to Take Action Today

You don’t need to be an expert, but you do need to start somewhere. Here’s what you can do right now:

- Follow key industry updates. Subscribe to reliable sources to stay informed.

- Invest in learning before investing money. Read, watch, and absorb knowledge before making financial commitments.

- Take security seriously. Use strong passwords, hardware wallets, and secure platforms for transactions.

If you’re already in the crypto space, ask yourself: Are you preparing for what’s next?

The future of cryptocurrency isn’t a mystery—it’s unfolding in real-time. Are you paying attention?

Disclaimer : Rubcrypto’s content is for informational purposes only, not investment advice. Cryptocurrency trading carries significant risks, including volatility and potential capital loss. Always conduct your own research and consult a financial advisor before making decisions. You alone bear responsibility for your investments.