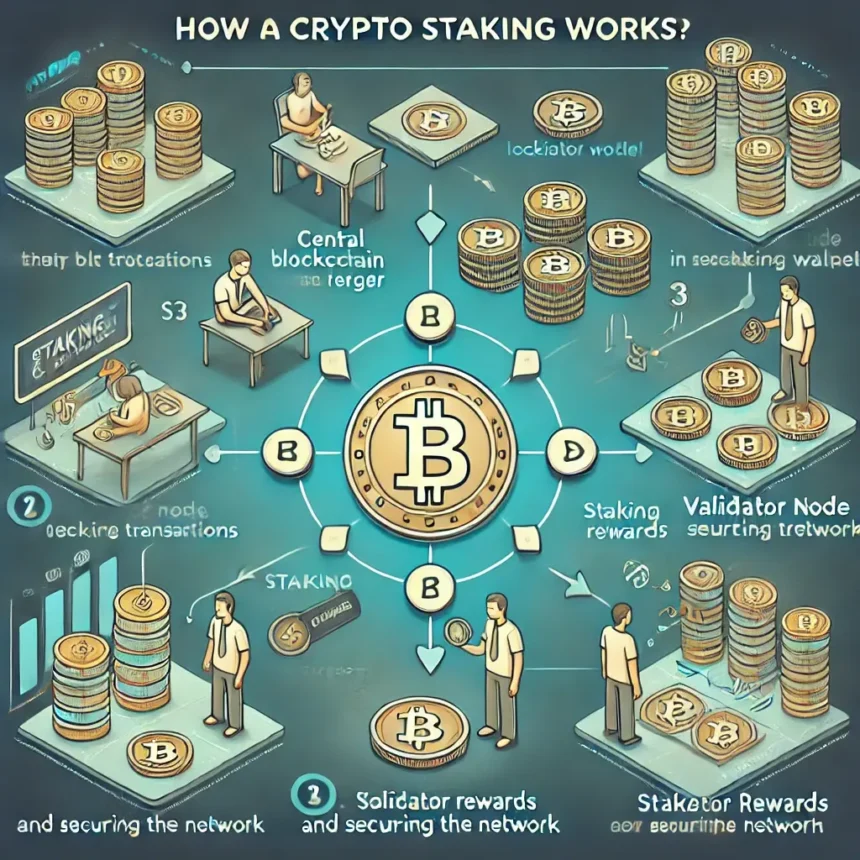

Crypto staking is an excellent way for investors to earn passive income while supporting blockchain networks. If you’re new to staking, understanding the process can help you maximize rewards while minimizing risks. This guide walks you through the step-by-step process of staking cryptocurrencies.

Step 1: Choose a Staking-Compatible Cryptocurrency

Not all cryptocurrencies support staking. Look for assets that operate on Proof-of-Stake (PoS) or Delegated Proof-of-Stake (DPoS) blockchains. Some popular staking coins include:

Step 2: Select a Staking Method

There are different ways to stake your cryptocurrency, and choosing the right method depends on your technical knowledge and investment goals:

Step 3: Set Up a Compatible Crypto Wallet

To stake your tokens securely, you need a compatible wallet that supports staking. Options include:

Step 4: Delegate or Lock Your Tokens

Once your wallet is set up, the next step is to lock your tokens for staking:

Step 5: Monitor Rewards & Withdraw Earnings

After staking, rewards will be distributed based on the network’s staking model. Important considerations include:

Risks & Best Practices for Staking

While staking is a great way to earn passive income, it comes with potential risks:

Final Thoughts

Crypto staking provides an opportunity for passive income while contributing to network security. Whether you’re using an exchange, a staking pool, or running a validator, always research and diversify to mitigate risks.

Disclaimer: This content is compiled from third-party sources, and the views expressed belong solely to the respective authors or entities. They do not reflect the opinions of RubCrypto. We neither guarantee nor endorse the accuracy, reliability, or completeness of the information provided and hold no responsibility for its content. Readers are encouraged to verify all details independently. RubCrypto disclaims any express or implied warranties related to this report and its contents.