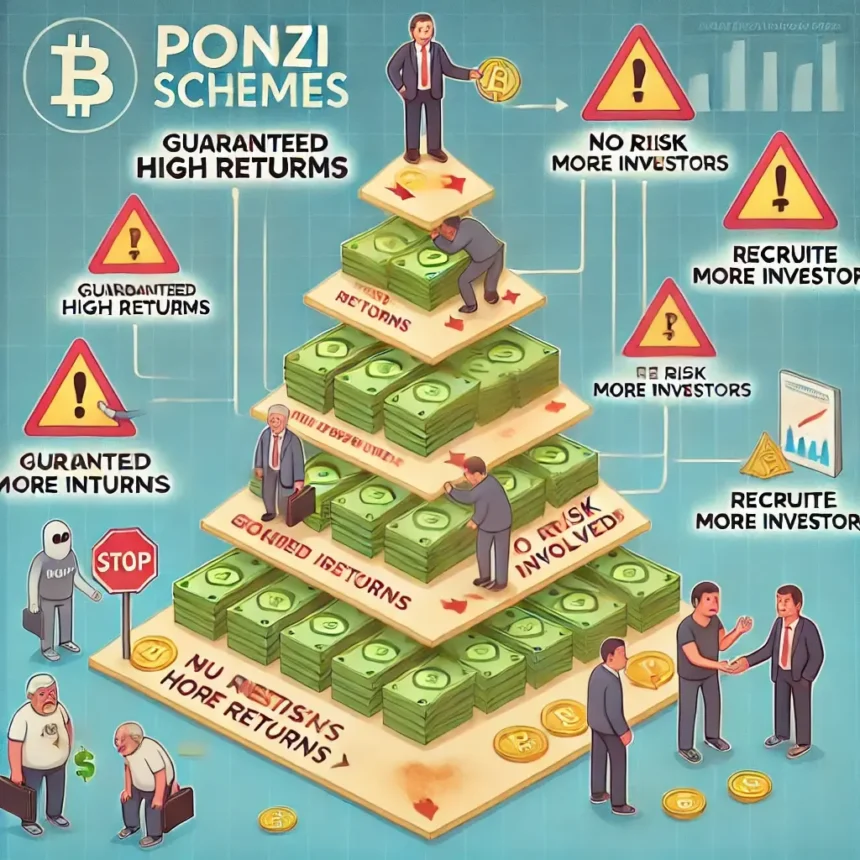

Ponzi schemes are one of the oldest and most deceptive financial scams, and they have found a new home in the cryptocurrency world. These fraudulent investment schemes promise high returns with little to no risk, but in reality, they rely on money from new investors to pay returns to earlier investors. Eventually, they collapse, leaving most participants with huge losses.

How Ponzi Schemes Work

A Ponzi scheme operates by recruiting new investors whose funds are used to pay returns to earlier investors. The scam depends on a continuous flow of fresh investments to sustain payouts. However, since no real profits are generated, the scheme eventually collapses when the number of new investors declines, leading to financial ruin for those who joined late.

The cycle typically follows these stages:

- Initial Hype and Promises – The scheme attracts investors by promising guaranteed high returns, often with little risk. Scammers use buzzwords like “passive income” or “next big opportunity.”

- Early Payouts to Gain Trust – Initial investors receive returns, usually paid using money from newer investors. This builds credibility and attracts more people.

- Rapid Expansion and More Investments – As word spreads, more investors pour in money, unaware that their returns come from others’ deposits rather than actual profits.

- Inevitable Collapse – At some point, recruitment slows, and the scheme can no longer sustain payouts. The organizers either disappear with the remaining funds or the entire operation collapses.

Real-Life Ponzi Schemes in Crypto

Bitconnect (2016–2018)

One of the most infamous crypto Ponzi schemes, Bitconnect, promised up to 40% monthly returns through its “trading bot.” Investors were encouraged to lend their Bitcoin in exchange for Bitconnect’s native token (BCC). For a while, the scheme thrived, but when regulators cracked down in early 2018, the platform collapsed, and investors lost billions.

OneCoin (2014–2019)

Another massive Ponzi scheme, OneCoin, claimed to be the next Bitcoin, luring in over $4 billion from investors worldwide. However, OneCoin had no blockchain or real cryptocurrency behind it. The scheme was eventually exposed, and its founder, Ruja Ignatova, vanished in 2017.

Warning Signs of a Ponzi Scheme

1. Guaranteed High Returns with Little or No Risk

If an investment promises consistently high profits with no downside, it’s likely a scam. Legitimate investments always carry some level of risk.

2. Lack of Transparency

Ponzi schemes often have vague or overly complex business models, making it difficult to understand how profits are generated. If a company refuses to disclose real trading or business activity, be cautious.

3. Pressure to Recruit Others

Many Ponzi schemes function like pyramid schemes, rewarding investors for bringing in new participants rather than for actual business activity.

4. Difficulty Withdrawing Funds

If an investment platform delays withdrawals, imposes unreasonable conditions, or suddenly changes policies, it may be a Ponzi scheme on the verge of collapse.

5. No Real Product or Service

A legitimate investment should have a clear product, service, or business model. If the only source of returns is new investors’ money, it’s a scam.

How to Protect Yourself from Ponzi Schemes

- Do Your Own Research (DYOR): Always investigate a project before investing. Look for real use cases, a working product, and verifiable team members.

- Check Regulatory Warnings: Many financial regulators issue warnings about suspicious investment schemes. Always verify if a company is registered with the appropriate authorities.

- Be Skeptical of Unrealistic Promises: If it sounds too good to be true, it probably is.

- Avoid Blindly Following Influencers: Scammers often use influencers and celebrities to promote their schemes. Always verify claims independently.

Final Thoughts

Ponzi schemes prey on greed and ignorance, offering promises of easy wealth while leaving most investors with devastating losses. The best defense is education and skepticism—always research before investing and avoid schemes that rely on recruitment rather than real economic activity.

Disclaimer: This content is compiled from third-party sources, and the views expressed belong solely to the respective authors or entities. They do not reflect the opinions of RubCrypto. We neither guarantee nor endorse the accuracy, reliability, or completeness of the information provided and hold no responsibility for its content. Readers are encouraged to verify all details independently. RubCrypto disclaims any express or implied warranties related to this report and its contents.